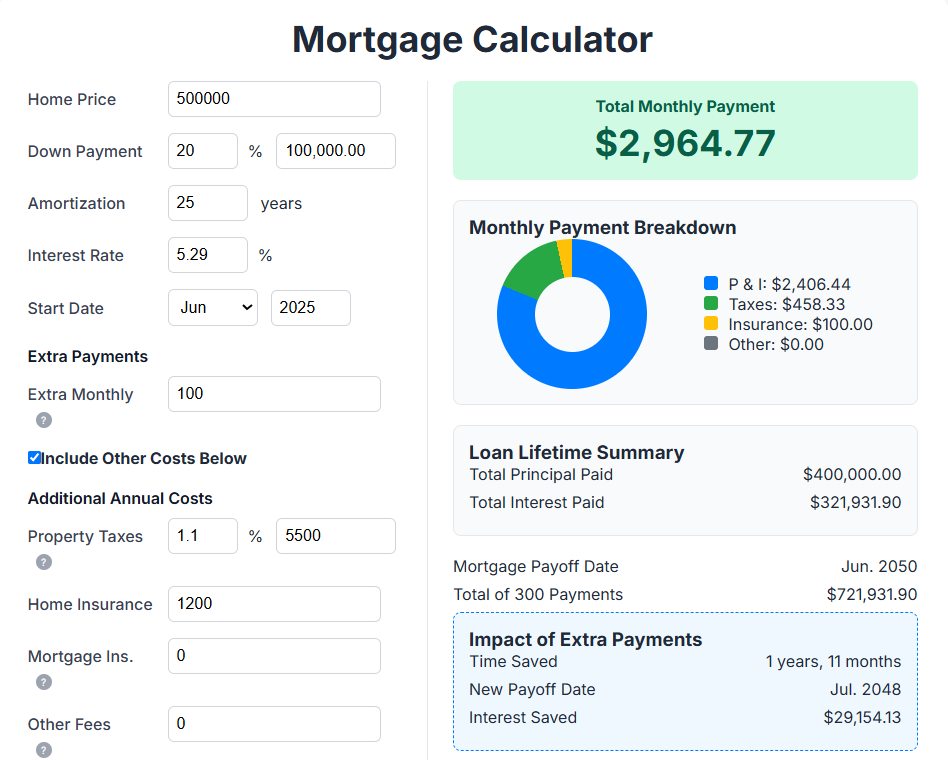

Did you know that on a $400,000 mortgage, you’ll end up paying a staggering $321,931.90 in interest alone? That’s almost 80% of the original loan amount in extra costs! Your credit score is the single most important factor that lenders consider when approving loans, and understanding the true cost of borrowing can save you thousands. That’s why we created UnitCalcPro – a comprehensive suite of free online calculators designed to empower you to make informed decisions in every aspect of your life.

As a calc unit enthusiast, I’ve seen how proper calculations can transform financial planning. When using our calculator unit tools, you’ll notice that a larger part of your payment goes toward interest in the beginning, which is crucial knowledge for anyone managing loans. In this beginner’s guide, I’ll walk you through everything you need to know about mastering UnitCalcPro. From navigating the dashboard to interpreting results, you’ll learn how to leverage our wide range of free, easy-to-use calculators for your financial, health, and everyday conversion needs.

Table of Contents

Getting Started with UnitCalcPro

UnitCalcPro opens up a world of calculation possibilities right at your fingertips. For this reason, I’m excited to help you get started with this versatile tool that makes complex calculations simple.

What is UnitCalcPro and what can it do?

UnitCalcPro is a comprehensive suite of online calculators designed to handle various calculation needs across different aspects of life. Essentially, it offers a wide range of free, easy-to-use calculators for your financial planning, health tracking, and everyday unit conversion requirements.

The power of unitcalcpro lies in its versatility. Whether you need to convert units, calculate loan payments, or track fitness metrics, this calc unit tool eliminates the need for multiple specialized calculators. Additionally, it provides visual representations of your results through graphs and tables, making complex information easier to understand.

How to access and navigate the dashboard

To begin with, you can access UnitCalcPro directly through your web browser. Once you’re on the dashboard, you’ll notice a clean, intuitive interface organized by calculator categories. The main navigation menu displays the three primary sections (Financial, Health & Fitness, and Unit Converters), allowing you to quickly find the specific calculator you need.

Each calculator features input fields where you enter your values and clearly labeled buttons for performing calculations. The results appear instantly, often with supplementary information to help you interpret the data correctly.

Understanding the categories: Financial, Health, and Unit Converters

The Financial section includes powerful tools like loan calculators, mortgage calculators, and compound interest worksheets. These calculator units help you analyze payment schedules, interest breakdowns, and long-term financial projections.

For health-conscious users, the Health & Fitness category offers calculators to track various wellness metrics and fitness goals.

The Unit Converters section is particularly robust, featuring tools to:

- Convert between length units (kilometers, miles, feet, meters)

- Transform area measurements (square meters, square feet, acres)

- Calculate volume conversions (liters, gallons, cubic meters)

- Convert temperature, weight, time, and many other units

This makes unitcalcpro invaluable for anyone who needs to calculate unit price or convert between different measurement systems for work, study, or personal projects.

How to Use the Calculator Tools

Using UnitCalcPro’s calculators is straightforward once you understand the basic principles. I’ve found that mastering these tools can transform how you make financial decisions and handle everyday calculations.

Entering values and interpreting results

The beauty of UnitCalcPro lies in its instant calculation capabilities. Whenever you enter a value in any field, the results update automatically as you type. This real-time feature eliminates waiting and makes calculations efficient. To use any calculator, I follow these simple steps:

- Select the appropriate input field for my starting unit

- Enter my value into the selected field

- View the instant results across all other related fields

When I need to perform a new calculation, I simply delete the number in any input box, and all fields clear automatically.

Using the loan and mortgage calculators

The mortgage calculator reveals both monthly payments and long-term costs. When I adjust the interest rate, even a fraction of a percent shows potential savings over time.

The most powerful feature I’ve discovered is the “Extra Monthly Payment” field. Any amount entered here applies directly to the principal, which helps:

- Save thousands in interest

- Pay off mortgages years sooner

- Build equity faster

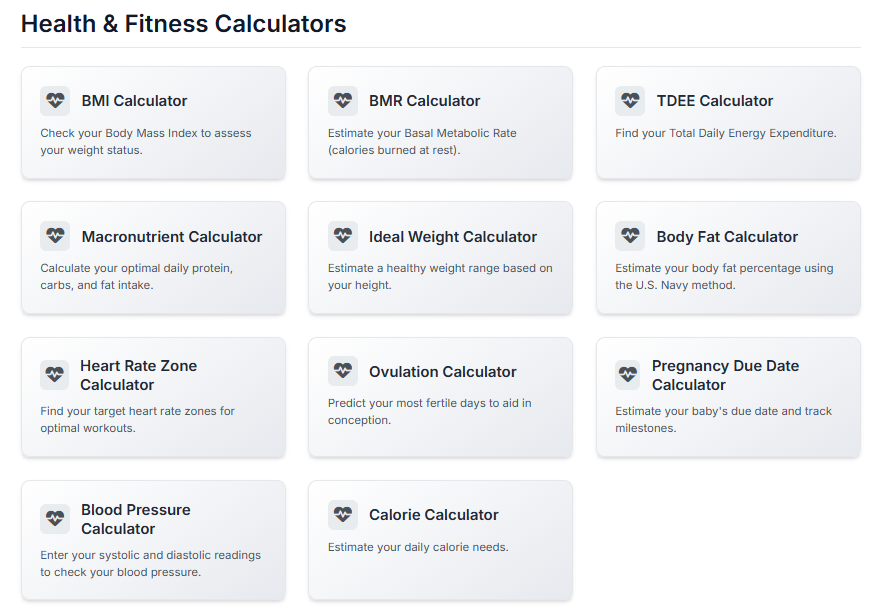

Exploring health and fitness calculators

UnitCalcPro offers comprehensive health tracking through calculators like BMI, BMR, body fat percentage, and calorie calculators. Each tool serves a specific purpose in monitoring different aspects of wellness. For example, the BMI calculator assesses weight status, while the BMR calculator determines daily calorie needs.

How to calculate unit price with unit converters

To calculate unit price effectively:

First, I divide the total price by the total quantity using the formula: unit price = total price ÷ total quantity.

Sometimes, I need to convert units first. For instance, when comparing a 32-ounce product priced at $6.38, I convert to pounds (32 oz ÷ 16 oz/lb = 2 lbs) before calculating the unit price ($6.38 ÷ 2 lbs = $3.19 per lb). This process helps me identify which package offers the best value, often revealing that larger sizes aren’t always the better deal.

Understanding Key Features and Functions

The true power of UnitCalcPro’s financial calculators lies in their ability to reveal the complete picture of your loans and investments. As I’ve discovered, understanding these advanced features dramatically improves financial decision-making.

Amortization and interest breakdowns

Amortization is the systematic process of paying off debt over time through predetermined installments. When using the calc unit tools in UnitCalcPro, you’ll see how each payment splits between principal and interest. Initially, a larger percentage of each payment goes toward interest since your loan balance is highest. Subsequently, as the balance decreases, the interest portion shrinks, allowing more of each payment to reduce the principal.

The amortization tables in unitcalcpro provide complete transparency, showing:

- Exactly how much you’ll pay monthly

- The specific amount allocated to principal versus interest

- Your remaining balance after each payment

This breakdown helps with budgeting and identifying potential tax deductions, as some types of interest may be tax-deductible.

Extra payment and savings projections

Perhaps the most valuable calculator unit feature is the ability to model extra payments. By making additional payments toward your principal, you can significantly reduce your loan term and save thousands in interest charges.

For instance, adding just $50 monthly to a $300,000 mortgage at 3.8% APR saves $12,199.92 in interest and shortens the loan by nearly two years. Furthermore, increasing extra payments to $250 monthly saves $47,587.51 and cuts the term by over seven years.

Alternatively, unitcalcpro allows you to analyze biweekly payment strategies, where you make half your mortgage payment every two weeks. This results in 13 full payments annually instead of 12, effectively adding one extra payment each year.

Visualizing results with graphs and tables

UnitCalcPro transforms complex financial data into intuitive visual representations. The calc unit tools generate charts that display your financial projections graphically, making it easier to understand long-term impacts of different payment strategies.

These visualizations update automatically when you adjust variables, allowing you to compare scenarios side-by-side and immediately see how changes affect your financial future.

Tips to Get the Most Out of UnitCalcPro

After using UnitCalcPro extensively, I’ve compiled these essential tips to enhance your calculation experience and avoid common pitfalls.

Choosing the right calculator for your needs

When selecting a calculator in UnitCalcPro, consider your specific calculation objectives. For financial planning, the Investment Calculator offers comprehensive projections when you input your starting amount, additional contributions, and estimated rate of return. Moreover, if you’re analyzing interest growth, the Interest Calculator allows you to model both simple and compound interest scenarios.

The scientific calculator provides advanced functions like trigonometry, logarithms, and constants for academic or professional calculations. Primarily, what will dictate your calculator choice is access to the specific buttons and functions you’ll use most frequently.

Avoiding common input mistakes

A critical factor in getting accurate results is understanding the order of operations (PEMDAS/BODMAS) that UnitCalcPro follows. Calculations inside parentheses are performed first, followed by exponents, multiplication/division, and finally addition/subtraction.

Common input errors to prevent include:

- Forgetting to switch between degrees and radians for trigonometric functions

- Overlooking compounding frequency settings in financial calculators

- Mismatching parentheses in complex calculations

When using the interest calculator, specifically follow the step-by-step process: enter principal amount, set annual interest rate, define time period, choose interest type, select compounding frequency, and then calculate.

Saving and comparing multiple scenarios

One of UnitCalcPro’s most powerful features is the ability to create and compare different calculation scenarios. This function allows you to switch between various sets of values and analyze different outcomes without reentering data.

For investment planning, I recommend creating multiple scenarios with different variables. For instance, compare conservative versus aggressive investment returns or analyze how inflation impacts your purchasing power over time.

After creating scenarios, you can generate summary reports that display side-by-side comparisons, highlighting the differences between each set of assumptions. This visualization makes it significantly easier to determine which financial strategies yield the best long-term results.

Conclusion

UnitCalcPro truly stands as an essential tool for anyone looking to make informed decisions through accurate calculations. Throughout this guide, we’ve explored how this versatile calculator suite handles everything from complex mortgage scenarios to health metrics and unit conversions.

Most importantly, UnitCalcPro reveals the hidden costs in financial decisions that many people miss. The ability to visualize payment breakdowns, compare scenarios, and project savings makes financial planning significantly more accessible and transparent [29].

The dashboard navigation, though initially overwhelming to some users, becomes second nature after a few sessions. Additionally, the real-time calculation feature eliminates waiting time and streamlines the entire process of working with numbers.

Mastering the amortization tables and interest breakdowns will certainly transform your approach to loans and mortgages. The knowledge that small extra payments can save thousands over the life of a loan empowers you to take control of your financial future [30].

Remember that practice makes perfect when using calculation tools. Start with simple calculations before advancing to more complex scenarios. Despite its robust features, UnitCalcPro maintains an intuitive design that grows with your confidence.

The next time you face a financial decision, health tracking need, or unit conversion challenge, UnitCalcPro will serve as your reliable calculation companion. Above all, the skills you develop through regular use of these calculators extend beyond the tool itself – they build financial literacy and numerical confidence that benefit countless areas of life.

Whether you’re calculating mortgage payments, tracking fitness goals, or comparing unit prices while shopping, UnitCalcPro eliminates guesswork and provides clarity through numbers. Your journey to calculation mastery starts with understanding the basics we’ve covered and continues with regular application of these powerful tools.

FAQs

Q1. What is UnitCalcPro and what are its main features?

UnitCalcPro is a comprehensive online calculator suite offering tools for financial planning, health tracking, and unit conversions. Its main features include loan and mortgage calculators, health and fitness calculators, and various unit converters, all designed to provide instant calculations and visual representations of results.

Q2. How can UnitCalcPro help with mortgage calculations?

UnitCalcPro’s mortgage calculator allows users to calculate monthly payments, view long-term costs, and analyze the impact of extra payments. It provides amortization schedules, interest breakdowns, and visualizations to help users understand how changes in variables affect their mortgage over time.

Q3. Can UnitCalcPro be used for health and fitness tracking?

Yes, UnitCalcPro includes health and fitness calculators such as BMI, BMR, body fat percentage, and calorie calculators. These tools help users monitor different aspects of their wellness and fitness goals by providing instant calculations based on input data.

Q4. How does UnitCalcPro handle unit conversions?

UnitCalcPro offers a robust unit conversion section that can convert between various units of measurement including length, area, volume, temperature, weight, and time. This feature is particularly useful for calculating unit prices or converting between different measurement systems for work or personal projects.

Q5. What are some tips for getting the most out of UnitCalcPro?

To maximize UnitCalcPro’s potential, users should choose the right calculator for their specific needs, avoid common input mistakes by understanding the order of operations, and utilize the feature that allows saving and comparing multiple scenarios. Regular practice with the tool will also help users become more proficient in making informed financial and health-related decisions.